Discover the best CRM for accountants and revolutionize your accounting practice. This powerful tool offers a suite of features designed specifically to streamline your workflows, enhance client relationships, and drive efficiency to new heights.

With a CRM tailored to the unique needs of accountants, you can effortlessly manage contacts, automate tasks, generate invoices, and generate insightful reports. Say goodbye to manual processes and embrace a world of seamless accounting.

Best CRM Features for Accountants

Accounting firms can streamline their operations and enhance client satisfaction by leveraging the capabilities of a robust CRM system. Specific features that are particularly valuable for accountants include:

Contact Management

A CRM’s centralized contact database allows accountants to effortlessly manage client information, including contact details, communication history, and preferences. This comprehensive view enables efficient communication, personalized interactions, and seamless collaboration among team members.

Task Management

Task management features within a CRM streamline project coordination and ensure timely completion of accounting tasks. Accountants can assign tasks to team members, set deadlines, track progress, and receive automated reminders. This organized approach enhances accountability, reduces bottlenecks, and ensures that all essential tasks are completed on time.

Invoicing and Billing

Integrated invoicing and billing capabilities in a CRM simplify the billing process for accountants. They can create and send invoices directly from the CRM, track payments, and manage outstanding balances. This automation eliminates manual data entry, reduces errors, and improves cash flow visibility.

Reporting and Analytics, Best crm for accountants

Robust reporting and analytics tools provide accountants with valuable insights into their client base, revenue trends, and team performance. They can generate customized reports, track key metrics, and identify areas for improvement. This data-driven approach empowers accountants to make informed decisions, optimize their processes, and enhance client satisfaction.

Benefits of Using a CRM for Accountants

Incorporating a customer relationship management (CRM) system can be transformative for accounting professionals, offering a range of advantages that streamline operations, enhance client engagement, and safeguard sensitive data.

Improved Client Relationships

- Centralized client information: CRMs consolidate all client-related data in one accessible location, enabling accountants to quickly retrieve and update contact details, transaction histories, and communication logs.

- Personalized interactions: By tracking client preferences and interactions, accountants can tailor their communication and service offerings to meet specific needs, fostering stronger relationships.

- Automated communication: CRMs automate email campaigns, appointment reminders, and other communications, freeing up accountants to focus on value-added tasks and providing a seamless client experience.

Increased Productivity

- Streamlined workflows: CRMs automate repetitive tasks such as data entry, scheduling, and follow-ups, allowing accountants to allocate more time to complex and strategic activities.

- Improved collaboration: Shared access to client information facilitates seamless collaboration among team members, eliminating communication gaps and ensuring a consistent level of service.

- Enhanced data accuracy: By eliminating manual data entry, CRMs minimize errors and ensure the accuracy of client records, reducing the risk of costly mistakes.

Enhanced Data Security

- Protected client information: CRMs employ robust security measures to safeguard sensitive client data, such as financial records and personal information, from unauthorized access.

- Compliance with regulations: Many CRMs are designed to comply with industry regulations and data protection laws, ensuring that accounting firms meet their legal obligations.

- Data backup and recovery: CRMs typically offer data backup and recovery features, protecting client information from loss due to hardware failures or cyberattacks.

Considerations for Choosing a CRM for Accountants: Best Crm For Accountants

When selecting a CRM for accounting professionals, it’s crucial to consider several key factors to ensure the best fit for your specific needs. These include industry-specific features, ease of use, and seamless integration with your existing accounting software.

Industry-Specific Features

- Client management:Effectively track and manage client interactions, including communication history, appointments, and project timelines.

- Time and expense tracking:Accurately capture and monitor time spent on client work and expenses incurred, enabling efficient billing and project management.

- Document management:Securely store and organize client documents, such as tax returns, financial statements, and contracts, for easy access and retrieval.

- Reporting and analytics:Generate customized reports and dashboards to gain insights into client activity, identify trends, and improve service delivery.

- Industry compliance:Ensure the CRM complies with industry regulations and data security standards, protecting sensitive client information.

Ease of Use

- Intuitive interface:Choose a CRM with a user-friendly interface that is easy to navigate and requires minimal training for your team.

- Mobile accessibility:Ensure the CRM offers mobile apps for iOS and Android devices, allowing you to access and manage client data on the go.

- Automation tools:Utilize automation features to streamline tasks, such as sending appointment reminders, generating invoices, and tracking client communication.

- Customization options:Tailor the CRM to your specific workflow by customizing fields, creating custom views, and setting up automated processes.

Integration with Accounting Software

- Seamless integration:Choose a CRM that seamlessly integrates with your accounting software, allowing you to sync data between the two systems and eliminate manual data entry.

- Data synchronization:Ensure the CRM automatically updates client information, invoices, and payments in your accounting software, maintaining data consistency.

- Financial reporting:Leverage the integrated CRM and accounting data to generate comprehensive financial reports, providing a holistic view of your clients’ financial health.

- Enhanced collaboration:Improve collaboration between your accounting and sales teams by sharing client information and tracking interactions through the integrated CRM.

Comparison Table of CRM Solutions for Accountants

| CRM Solution | Industry-Specific Features | Ease of Use | Integration with Accounting Software |

|---|---|---|---|

| Salesforce | Robust industry-specific features, including client management, time tracking, and document management | User-friendly interface, but customization options can be complex | Seamless integration with QuickBooks, NetSuite, and Xero |

| HubSpot | Free CRM with basic features, including contact management and email marketing | Easy to use and set up, suitable for small accounting firms | Limited integration options with accounting software |

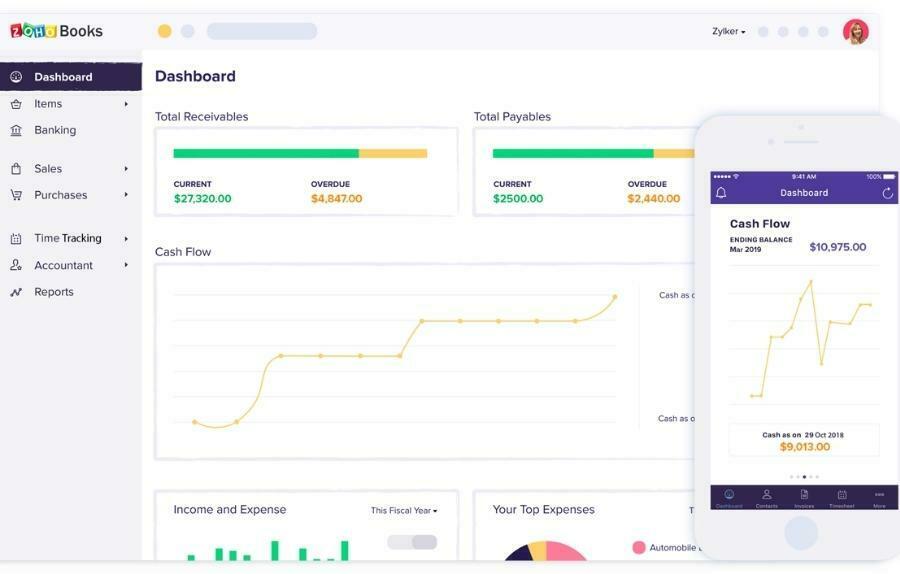

| Zoho CRM | Comprehensive CRM suite with industry-specific modules for accounting | Slightly complex interface, but offers advanced customization options | Seamless integration with Zoho Books and other popular accounting software |

| Freshsales | Cloud-based CRM with built-in phone and email features | Intuitive interface with drag-and-drop functionality | Integration with QuickBooks, Xero, and Sage 50cloud |

| Insightly | Flexible CRM with customizable dashboards and reporting tools | User-friendly interface with mobile app accessibility | Integration with QuickBooks, Salesforce, and Microsoft Dynamics |

Implementation and Best Practices for Accountants

Implementing a CRM in an accounting environment requires careful planning and execution. Here are the key steps involved:

Data Migration:Migrate existing client data, including contact information, financial records, and communication history, into the CRM. Ensure data accuracy and completeness.

User Training:Train accounting staff on the CRM’s features and functionality. This includes navigating the interface, managing client relationships, and leveraging reporting tools.

Ongoing Maintenance:Regularly update the CRM with new client information, interactions, and financial data. Monitor system performance and address any technical issues promptly.

Best Practices for Effective CRM Usage

To maximize the benefits of a CRM in accounting, consider these best practices:

- Customize Workflows:Tailor the CRM to align with specific accounting processes, such as lead generation, client onboarding, and tax preparation.

- Leverage Reporting Features:Utilize the CRM’s reporting capabilities to track key performance indicators (KPIs), analyze client trends, and identify growth opportunities.

- Integrate with Other Tools:Integrate the CRM with accounting software, email marketing platforms, and other relevant tools to streamline operations and improve efficiency.

- Encourage Collaboration:Foster teamwork by enabling multiple users to access and update client information, ensuring seamless communication and knowledge sharing.

- Continuously Evaluate and Improve:Regularly assess CRM usage and identify areas for improvement. Make adjustments to workflows, reporting, and integrations as needed to optimize performance.

Last Recap

In conclusion, investing in the best CRM for accountants is a game-changer for your practice. Its robust features, tailored to the accounting profession, will empower you to streamline operations, enhance client satisfaction, and gain a competitive edge. Embrace the future of accounting and unlock the full potential of your firm with the right CRM.

Popular Questions

What are the key features of a CRM for accountants?

A CRM for accountants should offer features such as contact management, task management, invoicing, reporting, and integration with accounting software.

How can a CRM improve efficiency for accountants?

A CRM can automate tasks, streamline workflows, and provide real-time insights, allowing accountants to work more efficiently and effectively.

What are the benefits of using a CRM for client relationships?

A CRM helps accountants track client interactions, manage communication, and build stronger relationships.