Best crm for accounting firms – In today’s competitive accounting landscape, a robust customer relationship management (CRM) system is indispensable for firms seeking to optimize client interactions, streamline operations, and drive growth. This comprehensive guide explores the best CRM solutions tailored specifically to the unique needs of accounting firms, empowering them to make informed decisions and unlock the full potential of CRM technology.

With the right CRM in place, accounting firms can gain a 360-degree view of their clients, automate time-consuming tasks, enhance communication, and foster lasting relationships. Discover the key features to consider, compare top vendors, learn from real-world case studies, and implement best practices to maximize the impact of CRM on your firm’s success.

Introduction

In today’s competitive business landscape, accounting firms need to leverage technology to streamline their operations and provide exceptional client service. A robust Customer Relationship Management (CRM) system is a vital tool that can help accounting firms manage client interactions, automate tasks, and gain valuable insights into their clients’ needs.

For accounting firms, a CRM system offers numerous benefits. It helps firms:

- Centralize client data in a single, easily accessible location

- Track client interactions and communication history

- Automate tasks such as scheduling appointments and sending reminders

li>Generate reports and analytics to identify trends and opportunities

Key Features

When selecting a CRM system for an accounting firm, it’s essential to consider the following key features:

- Client Management:The CRM should provide robust features for managing client data, including contact information, service history, and billing details.

- Task Management:The CRM should allow users to create and assign tasks, set deadlines, and track progress, ensuring efficient task management and collaboration.

- Communication Tracking:The CRM should enable users to log and track all client interactions, including emails, phone calls, and meetings, providing a comprehensive view of client communication.

- Reporting and Analytics:The CRM should offer robust reporting and analytics capabilities, allowing users to generate reports on client activity, revenue, and other key metrics, providing valuable insights for decision-making.

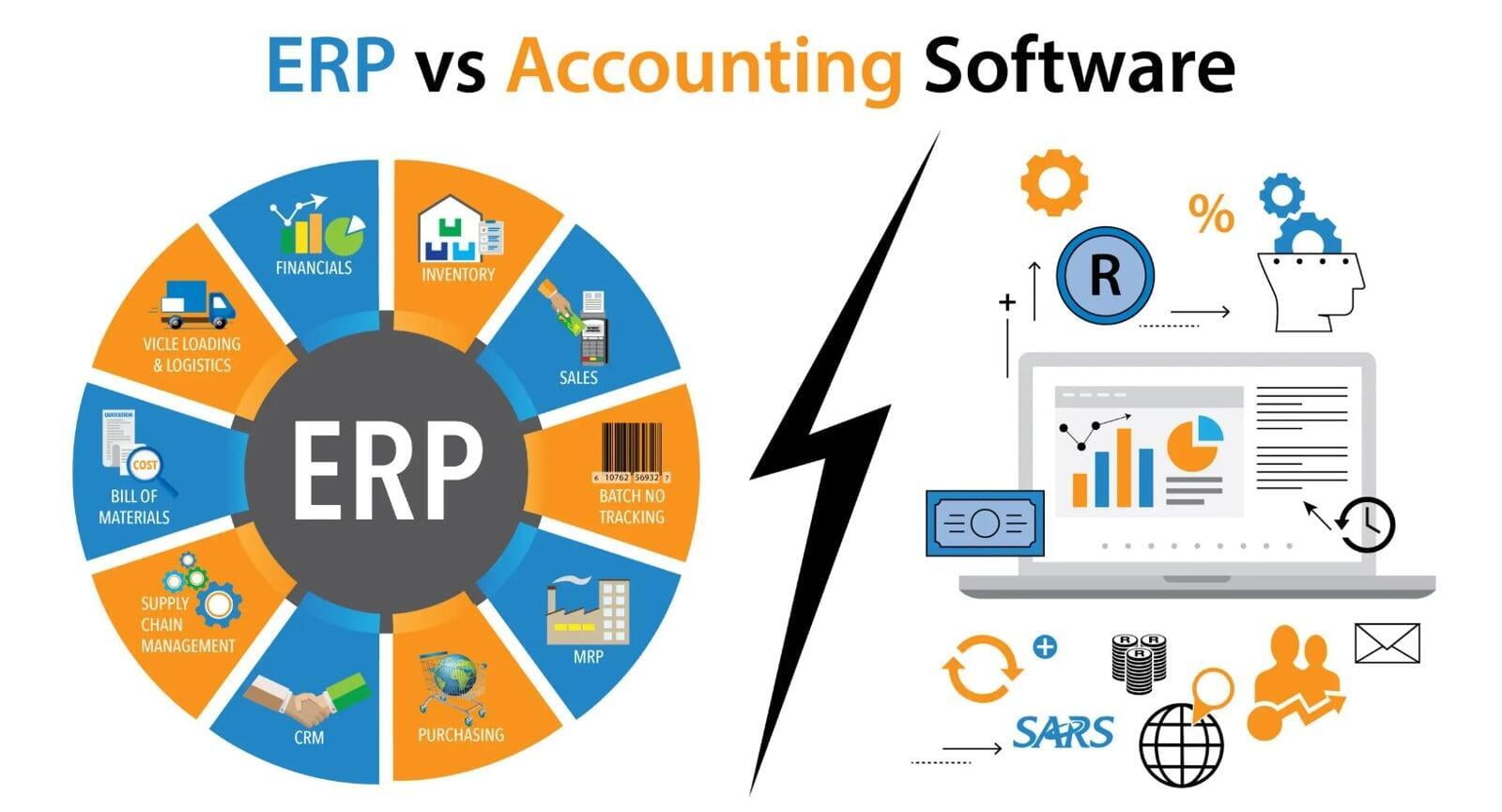

- Integration with Accounting Software:The CRM should seamlessly integrate with the firm’s accounting software, ensuring data synchronization and eliminating the need for manual data entry.

Top CRM Vendors for Accounting Firms

Choosing the right CRM for your accounting firm is essential for managing client relationships, automating tasks, and streamlining operations. Here’s a comparison of the top CRM vendors for accounting firms:

Vendor Comparison Table

| Vendor | Key Features | Pricing | Customer Reviews |

|---|---|---|---|

| Salesforce |

|

|

|

| Zoho CRM |

|

|

|

| HubSpot CRM |

|

|

|

| Freshsales CRM |

|

|

|

| Pipedrive CRM |

|

|

|

Case Studies

In the competitive landscape of accounting, implementing a CRM can significantly enhance client relationships, streamline operations, and drive growth. Several accounting firms have reaped the benefits of successful CRM implementations, leading to tangible improvements in their businesses.

By leveraging CRM systems, accounting firms can gain a comprehensive view of their clients, track interactions, automate tasks, and provide personalized services. This has resulted in increased client satisfaction, improved communication, and enhanced collaboration within the firm.

Accounting Firm A

- Challenge:Inefficient client management and limited visibility into client interactions.

- Solution:Implemented a cloud-based CRM to centralize client data and streamline communication.

- Benefits:Improved client engagement, increased productivity, and enhanced team collaboration.

Accounting Firm B

- Challenge:Lack of effective lead management and difficulty tracking sales opportunities.

- Solution:Integrated a CRM with lead generation tools to automate lead capture and nurture prospects.

- Benefits:Increased lead conversion rates, improved sales forecasting, and better pipeline management.

Accounting Firm C

- Challenge:Limited capacity to provide personalized client experiences and build strong relationships.

- Solution:Deployed a CRM with advanced segmentation and personalization capabilities.

- Benefits:Enhanced client loyalty, increased client referrals, and improved client satisfaction scores.

Best Practices for Implementing CRM in Accounting Firms

Implementing a CRM system in an accounting firm can streamline operations, improve client relationships, and boost revenue. Here’s a step-by-step guide to help you get started.

Getting Buy-in from Staff, Best crm for accounting firms

- Explain the benefits of CRM to your team, emphasizing how it will make their jobs easier and more efficient.

- Involve staff in the selection and implementation process to ensure their needs are met.

- Provide training and support to help staff understand and use the system effectively.

Measuring the Success of CRM

- Establish clear goals and metrics for CRM implementation, such as increased client satisfaction, improved sales conversion rates, or reduced operational costs.

- Track key performance indicators (KPIs) to monitor progress and identify areas for improvement.

- Regularly review and adjust the CRM strategy based on performance data.

Conclusion

In summary, CRM implementation for accounting firms offers numerous benefits, including improved client relationships, increased revenue, enhanced efficiency, and better decision-making.

For accounting firms considering implementing CRM, it is crucial to:

- Define clear goals and objectives.

- Choose a CRM vendor that aligns with your specific needs.

- Implement the CRM in a structured and phased approach.

- Train staff thoroughly and ensure adoption.

- Continuously monitor and evaluate CRM performance to identify areas for improvement.

By following these recommendations, accounting firms can leverage CRM to optimize their operations, enhance client experiences, and achieve long-term success.

Concluding Remarks: Best Crm For Accounting Firms

Embracing the power of CRM is a transformative step for accounting firms seeking to elevate their client service, boost efficiency, and position themselves for sustained growth. By carefully evaluating the options presented in this guide and implementing a CRM solution tailored to your firm’s specific requirements, you can unlock the full potential of this powerful technology and achieve remarkable results.

FAQ Insights

What are the key benefits of using a CRM for accounting firms?

CRMs help accounting firms streamline client interactions, automate tasks, gain a 360-degree view of clients, enhance communication, and improve overall efficiency.

What features should accounting firms look for in a CRM?

Key features include contact management, activity tracking, pipeline management, document storage, reporting, and integration with accounting software.

How can accounting firms measure the success of their CRM implementation?

Metrics such as increased client satisfaction, improved staff productivity, and enhanced profitability can indicate the success of a CRM implementation.